Managing finances in the contemporary landscape can pose various challenges, necessitating a comprehensive understanding of complex financial mechanisms and prudent decision-making skills. Several factors contribute to the complexities associated with financial management in the present-day context. These factors greatly affect our daily lives especially when it comes to budgeting and saving. Here are some friendly financial tips that can help you navigate the intricacies of personal finance with confidence and ease.

Budgeting: Your Financial Compass

Cultivate Savings Habits: The Power of Small Steps

Committing to a consistent savings regimen, no matter how modest, can yield significant long-term benefits. Consider automating your savings by setting up a direct deposit from your paycheck into a separate savings account. Cultivating this habit ensures the gradual accumulation of funds for future investments, emergencies, or other financial goals.

Plan for the Future: Invest Wisely

While saving is essential, consider exploring investment options to foster long-term financial growth. Educate yourself about various investment avenues, such as stocks, bonds, mutual funds, and real estate. Conduct thorough research or seek professional guidance to make informed investment decisions aligned with your risk tolerance and financial objectives.

Manage Debt Responsibly: A Balancing Act

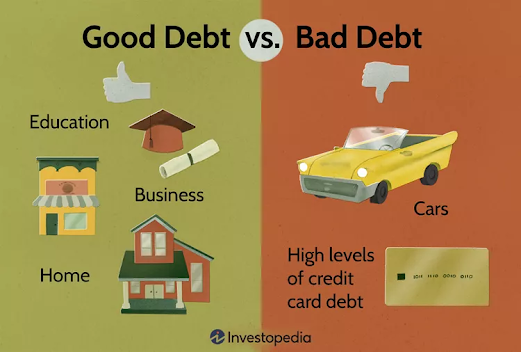

While taking on manageable debt can be beneficial for achieving specific goals, such as homeownership or education, it is crucial to manage debt responsibly. Prioritize the repayment of high-interest debts and consider consolidation options to streamline your repayment process. Avoid accumulating unnecessary debt from frivolous spending and ensure timely payments to maintain a positive credit score.

Prioritize Financial Literacy: Empower Yourself

Invest in your financial education by staying informed about current economic trends, financial news, and investment strategies. Attend workshops, read relevant literature, and leverage online resources to enhance your understanding of personal finance. A robust knowledge base equips you with the tools necessary to make informed financial decisions and navigate complex financial landscapes confidently.

Plan for Retirement: Secure Your Future

Initiate retirement planning early to secure a stable financial future. Explore retirement savings options such as employer-sponsored 401(k) plans, individual retirement accounts (IRAs), or pension plans. Evaluate your retirement goals and develop a comprehensive strategy to ensure financial security during your retirement years.

Emergency Funds: Prepare for the Unexpected

Establish an emergency fund to safeguard against unforeseen financial crises. Aim to accumulate at least three to six months' worth of living expenses in a readily accessible account. This safety net provides financial resilience during unexpected circumstances, such as job loss, medical emergencies, or unforeseen home repairs.

Regular Financial Assessments: Stay on Track

Conduct periodic evaluations of your financial health to gauge your progress and identify areas for improvement. Reassess your financial goals, adjust your budget as needed, and realign your investment strategy in response to changing life circumstances or financial objectives. Regular assessments empower you to make necessary adjustments and maintain a proactive approach to financial management.

By integrating these friendly financial tips into your daily routine, you can foster a healthy and sustainable approach to managing your personal finances. Remember that financial well-being is a journey, and small, consistent steps can lead to significant long-term financial stability and security.

No comments:

Post a Comment

Thanks for dropping by! Hope you can follow me:

Youtube: http://youtube.com/Pintura14

FB Pages: http://facebook.com/vintersections | http://facebook.com/i.imagine.green

Twitter/IG/Tiktok/Pinterest: @ronivalle